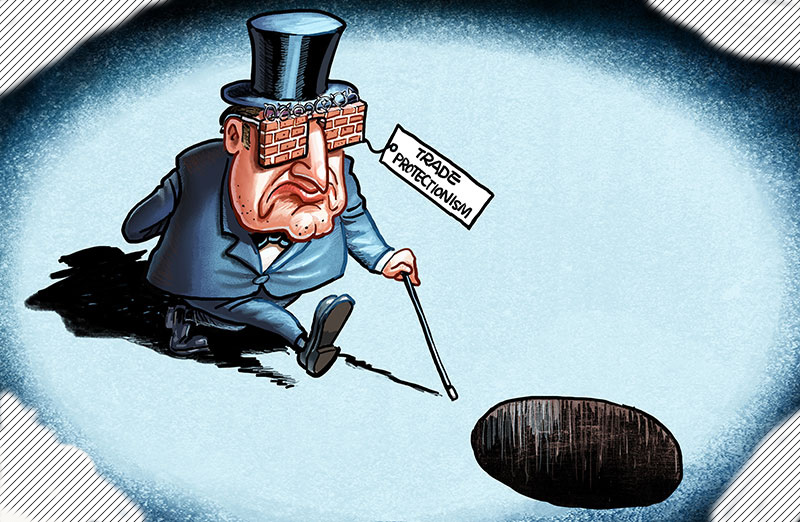

Trade protectionism is a type of policy that limits unfair competition from foreign industries. It’s a politically motivated defensive measure.

In the short run, it works.

But it is very destructive in the long term. It makes the country and its industries less competitive in international trade.

Countries use a variety of strategies to protect their trade. One way is to enact tariffs that tax imports. That immediately raises the price of imported goods. They become less competitive when compared to local products. This method works the best for countries with a lot of imports, such as the United States.

A second way of protecting trade is when the government subsidies local industries. Subsidies come in the form of tax credits or even direct payments. That allows producers to lower the price of local goods and services making local products cheaper. Subsidies work even better than tariffs. This method works best for countries that rely mainly on exports.

A third method is to impose quotas on imported goods. This method is more effective than the first two. No matter how low a foreign country sets the price through subsidies, it can’t ship more goods.

Most textbooks omit the fourth type of trade protectionism because it is subtle. It is a deliberate attempt by a country to lower its currency value. This would make its exports cheaper and more competitive. This method can result in retaliation and start a currency war. One way countries can lower their currency’s value through a fixed exchange rate. This is like China’s yuan. Another way is by creating so much national debt that it has the same effect, like the U.S. dollar decline.

Advantages

If a country is trying to grow strong in a new industry, tariffs will protect it from foreign competitors. That gives the new industry’s companies time to develop their competitive advantages.

Trade Protectionism also temporarily creates jobs for domestic workers. The protection of tariffs, quotas, or subsidies allows local companies to hire locally. This benefit ends once other countries retaliate by erecting their protectionism.

Disadvantages

In the long term, trade protectionism weakens the industry. Without competition, companies within the industry do not need to innovate. Eventually, the domestic product will decline in quality and be more expensive than what foreign competitors produce.

Free Trade Agreements

Free trade agreements reduce or eliminate tariffs and quotas between trading partners. The most significant agreement is the North American Free Trade Agreement. It is between the United States, Canada, and Mexico. The Trans-Pacific Partnership would have been broader. But President Trump withdrew the United States from that agreement. As a result, the other involved countries are forming their own accord. If China decides to join them, it will replace NAFTA as the world’s largest trade pact.

Also in the running for the world’s largest trade agreement would have been the Transatlantic Trade and Investment Partnership. It was between the European Union and the United States.

A sizeable multilateral trade pact is the Dominican Republic-Central American Free Trade Agreement, which is between the United States and Central America. There are also bilateral agreements with Chile, Colombia, Panama, Peru, Uruguay, and most countries in Southeast Asia. The United States also has agreements with the Middle Eastern countries of Israel, Jordan, Morocco, Bahrain, and Oman.

Despite their disadvantages for some, free trade agreements have more pros than cons.

If you liked this article and want to read other great stories, try our Archives. Also if you are new to investing you can try our Investment Basics Blog.

If you want to start investing with SSL but don’t have the time to monitor the market or to conduct the trades yourself then you can choose one of SSL’s managed Financial Planning products. We offer a variety of products for every type of investor and if you are interested in managing online trades yourself and having complete control over your investment portfolio then you can try SSL’s Brokerage account.

Follow us on Facebook, LinkedIn and Twitter please leave us a review.