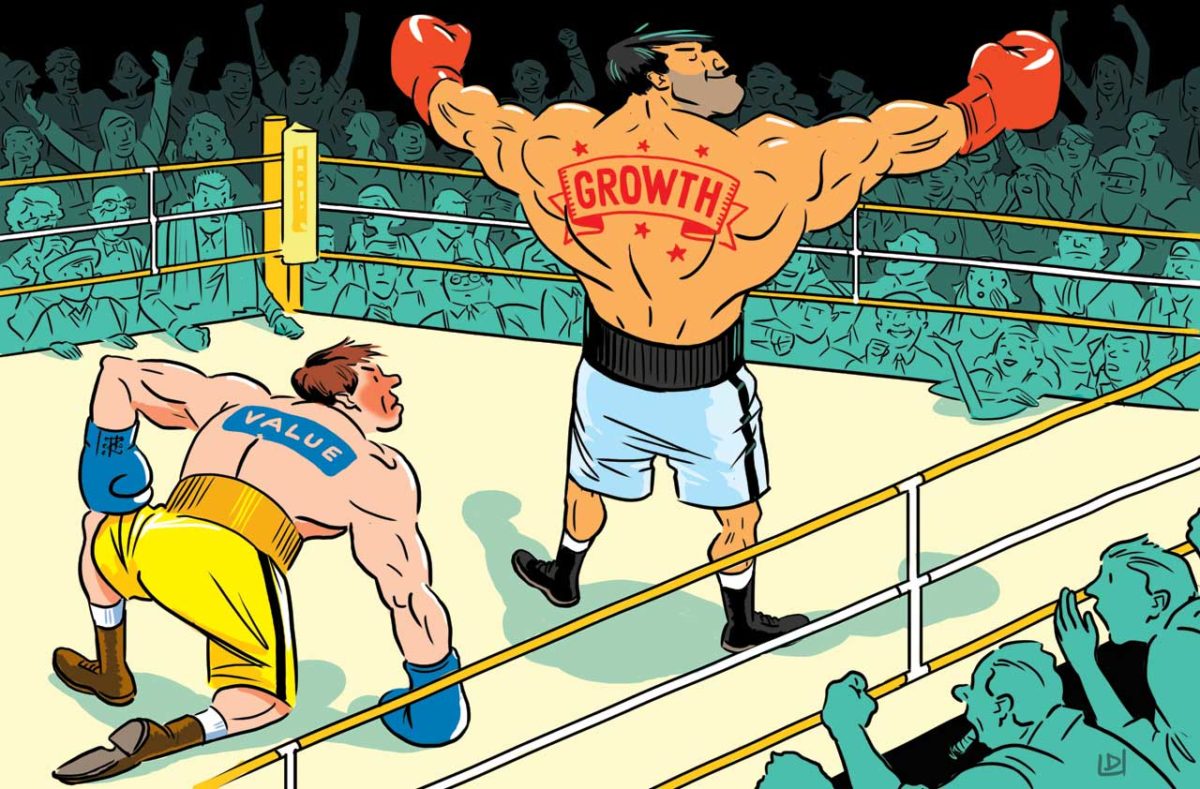

While growth stocks have prevailed since 2016, is value stocks about to have their day?

Possibly.

Growth stocks have been dominating the headlines and portfolios since the end of 2016. While investors have focused on earnings growth, an even better approach would have been to buy the stocks rising the fastest.

Year-to-date, growth stocks continue to outperform the rest of the market, but the regime may be shifting towards a different equity style. When uncertainty and volatility are rising, quality tends to outperform. Since the early summer, companies in the Morgan Stanley Capital International (MSCI) Quality Index have outperformed other investment styles as well as the broader market.

As a reminder, quality companies refers to firms with high return-on-equity (ROE), earnings consistency and low leverage. These characteristics suggest safety, which investors put a premium on when volatility increases.

It is standard practice to hold some quality in a portfolio. Since 1994 quality has produced higher monthly average returns than the S&P 500.

What should investors expect?

Volatility continues to rise into the end of the current cycle, putting aside the wild card of an escalating trade dispute, it is important to note that volatility typically rises towards the latter stages of bull markets, when financial conditions are tightening.

It is fair to say we are there today.

Wider credit spreads would be a good reason to hold more quality in your portfolio. A credit spread is the difference between the yields of a U.S. Treasury and another bond of the same maturity. When they widen, it is typically a sign of economic uncertainty; investors will hold “safe harbour” Treasuries, enter into private deals, hold ETFs and sell riskier bonds.

To date, rising rates and a stronger dollar have contributed to tighter financial conditions. What has offset these trends is still tight credit spreads. Benign credit markets have reassured investors and helped to keep economic conditions easier than you would expect. A widening of spreads, particularly for high yield bonds, would confirm a higher volatility regime. When that happens, volatility is likely to jump rather than creep higher, precisely the type of arrangement when quality’s relative performance has been most influential.

These may seem like extreme measures but understanding the change in the market cycle will provide investors with the opportunity trade long-term and maintain their capital.

Call us and speak to an advisor about our wide range of ETFs and Private Deals.

If you liked this article and want to read other great stories, try our Archives. Also if you are new to investing you can try our Investment Basics Blog.

If you want to start investing with SSL but don’t have the time to monitor the market or to conduct the trades yourself then you can choose one of SSL’s managed Financial Planning products. We offer a variety of products for every type of investor and if you are interested in managing online trades yourself and having complete control over your investment portfolio then you can try SSL’s Brokerage account.

Follow us on Facebook, LinkedIn and Twitter please leave us a review.